A crucial part of rental property management is ensuring your accounting process and all records are organized and orderly. According to statistics, approximately 44.1 million Americans are renters. That means your portfolio represents a portion of this staggering number.

Implementing an efficient, quality rental property accounting process makes handling transactions easy and efficient.

If you're looking for ways to manage your rental accounting records in Bend, Oregon, read on for a list of five helpful tips.

1. Adopt New Technology

Today, portfolio management relies on data and digital recordkeeping more than ever. Implement a property management software system that includes accounting as part of the complete package.

The days of only using paper records are a thing of the past, so it's important to use new software that keeps everything in one central location. If you're an owner, choose a property management company that already has its own software in place to save you time and money.

2. Itemize Income with Rental Property Accounting

The IRS requires all landlords to disclose the income they receive from rental properties. Use a "rent roll" to help you keep track of your income and keep up with monthly owner statements.

Rent rolls give you a snapshot of the overall income you expect to receive in the future along with your rental income history. It also keeps track of rent payments due, security deposits, and leases, all on a single document.

3. Track Expenses

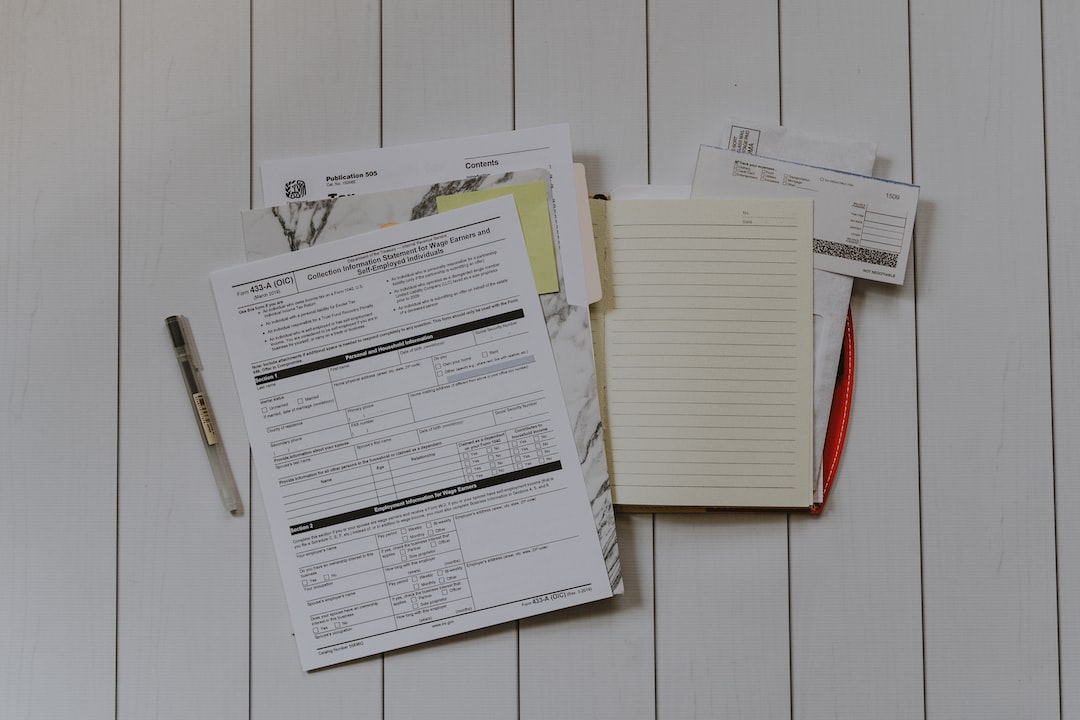

Aside from your rental income, it's also vital to keep records of all your expenses. You can use these records to log and maximize tax deductions and more.

Always note every single expense you pay, whether it's maintenance, court costs, or property management fees. Scan receipts and keep documentation of things like canceled checks and bills. Not only does this help you during tax time, but it also makes it easier to determine where and how your money is spent throughout the year.

4. Separate Your Finances

Even if you only own one rental property, it's crucial to make sure that you keep your personal and business finances separated. Get a separate checking and credit card account just for your rental unit or units. Use your rental property accounting software to track only the business portion.

Separating expenses and income makes filing taxes a whole lot easier, too. It also helps you keep your personal income and outflow where it should be, and avoids serious confusion when you need to track your money in terms of business spending and income.

5. Set a Budget

Every business should allot money for a budget, and that includes landlords. Whether it's for repairs and maintenance or lease enforcement, it's very important to have money set aside.

Determine how much cash you'll need before you start renting property. This provides a "cushion" in case you ever need to spend money out of pocket.

Recordkeeping Made Easy

Remember these rental property accounting tips to keep your income and expenses on track. The right process will make your portfolio management easier.

If you're interested in learning more about property management, contact PMI Central Oregon today!